Preparing Children for Money Management

My Pocket Money Diary

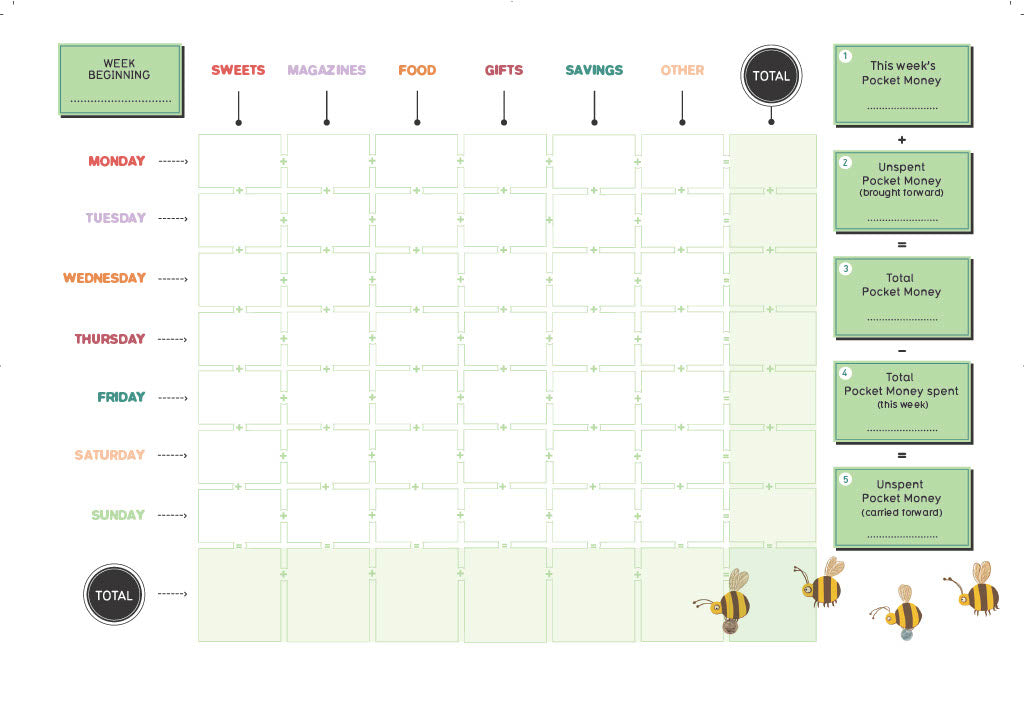

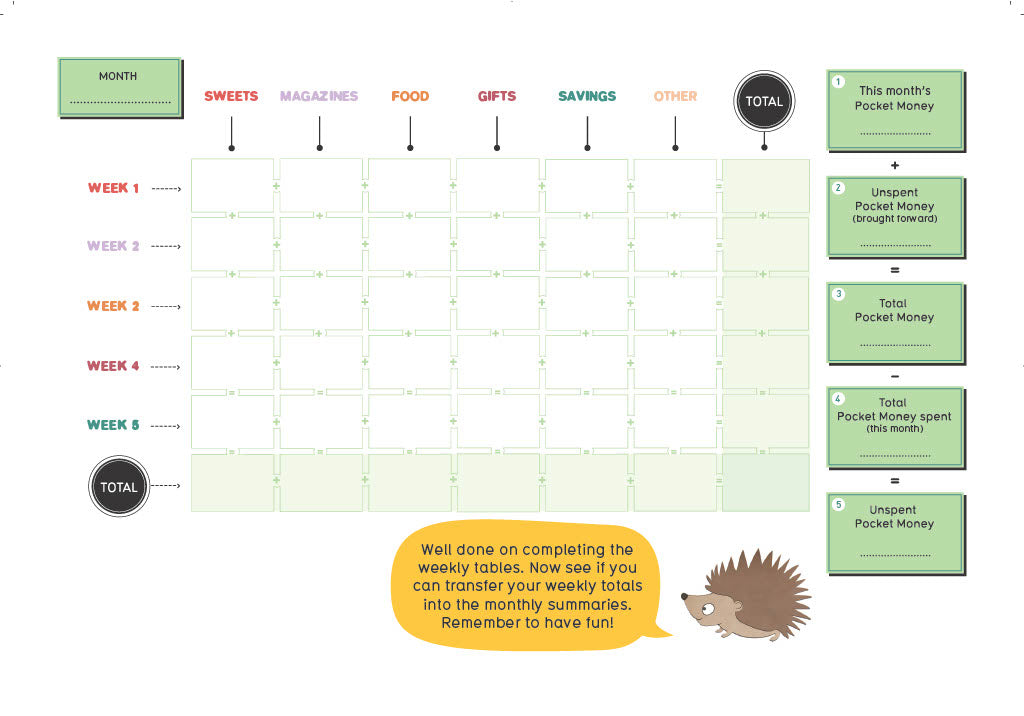

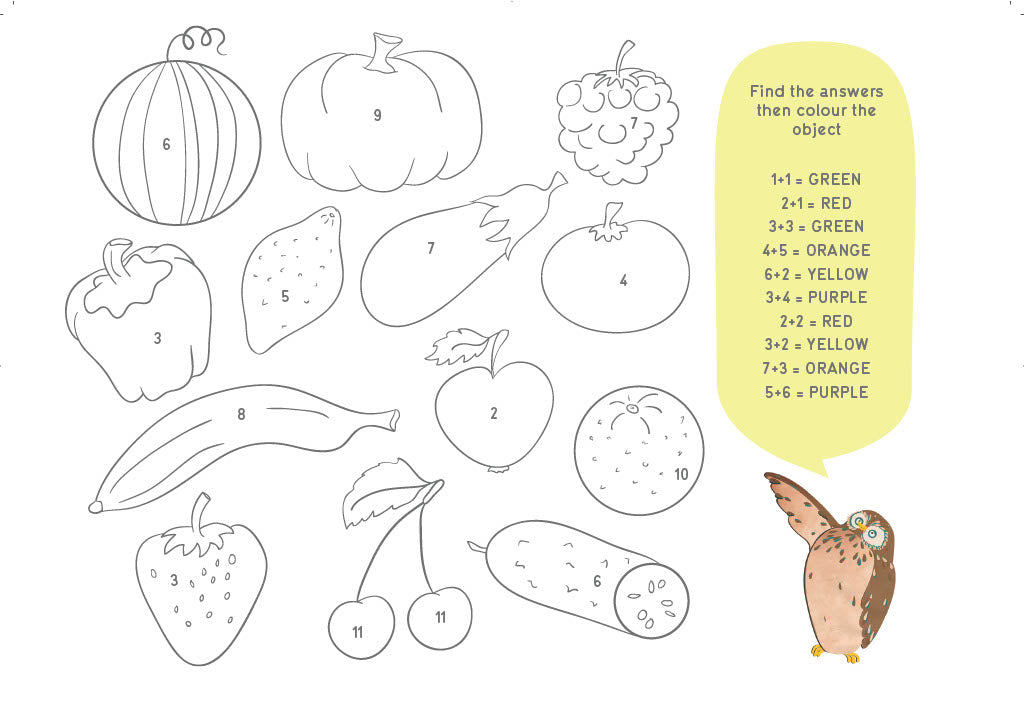

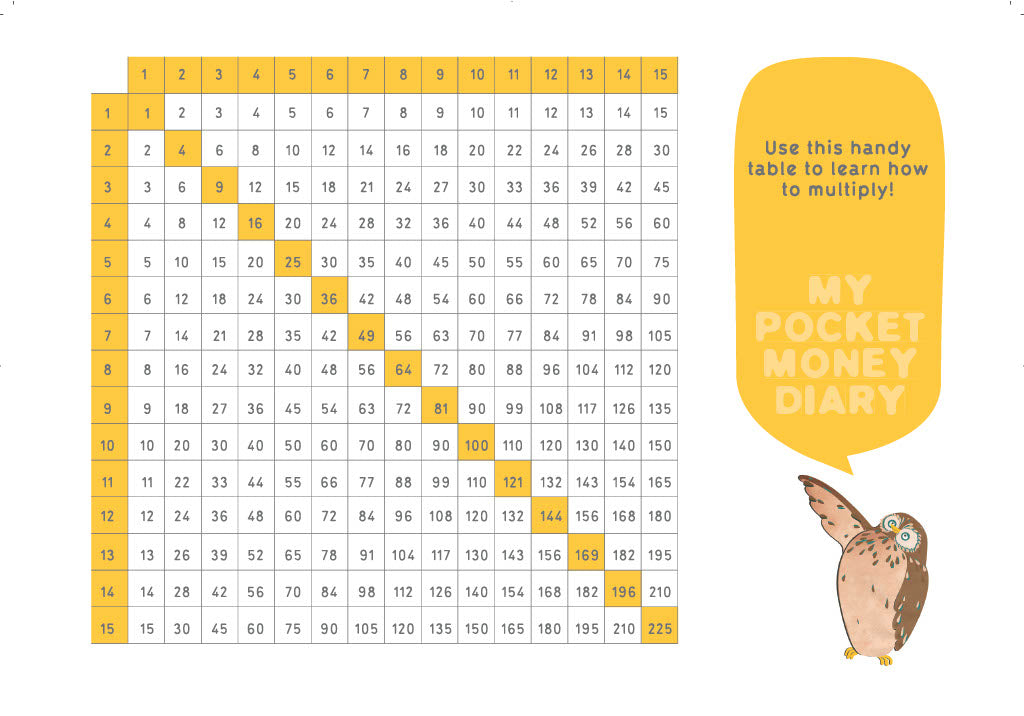

Introducing kids aged 4 to 7 to the world of money.🌟 Master Financial Concepts: Through weekly sheets, children track daily spending, nurturing a solid grasp of concepts like budgeting and saving, fostering wise spending decisions, and understanding money's true value.🌟 Support Academics: Practical exercises in math complement the school curriculum, with creative 'colour-by-numbers' exercises for a joyful learning experience.🌟 Empower for the Future: More than a diary, it's a stepping stone to foster financial responsibility, independence, and confidence in young minds.🚀 ***Multi Offer Discounts *** Free UK Shipping Up To £15.00***

Share

Learn more...

What are the benefits of this diary?

- Financial Literacy: The diary helps develop essential money skills to children aged 4 to 7, setting a strong foundation for their financial literacy.

- Smart Money Habits: The diary encourages the development of valuable financial habits, including smart spending and saving, which will serve children well throughout their lives.

- Parental Involvement: It facilitates parents in actively participating in their child's financial education, making it a collaborative and bonding experience.

- Life Skills: Beyond money management, the diary promotes essential life skills like decision-making and critical thinking, enhancing your child's overall development.

- Resource Management: It imparts the crucial understanding that money is a limited resource that should be managed wisely, instilling a sense of responsibility and prudence.

- Interactive and Educational: A 92-page diary that combines interactive activities, games, and exercises that make learning about money fun and hands-on.

- Instilling Responsibility and Independence: Children can gain valuable insights into the significance of taking care of their belongings and the value of hard work, especially when they earn pocket money through completing chores and other tasks.

- Boosting Confidence: Managing their own finances empowers children, leading to a sense of pride and increased self-confidence in their abilities.

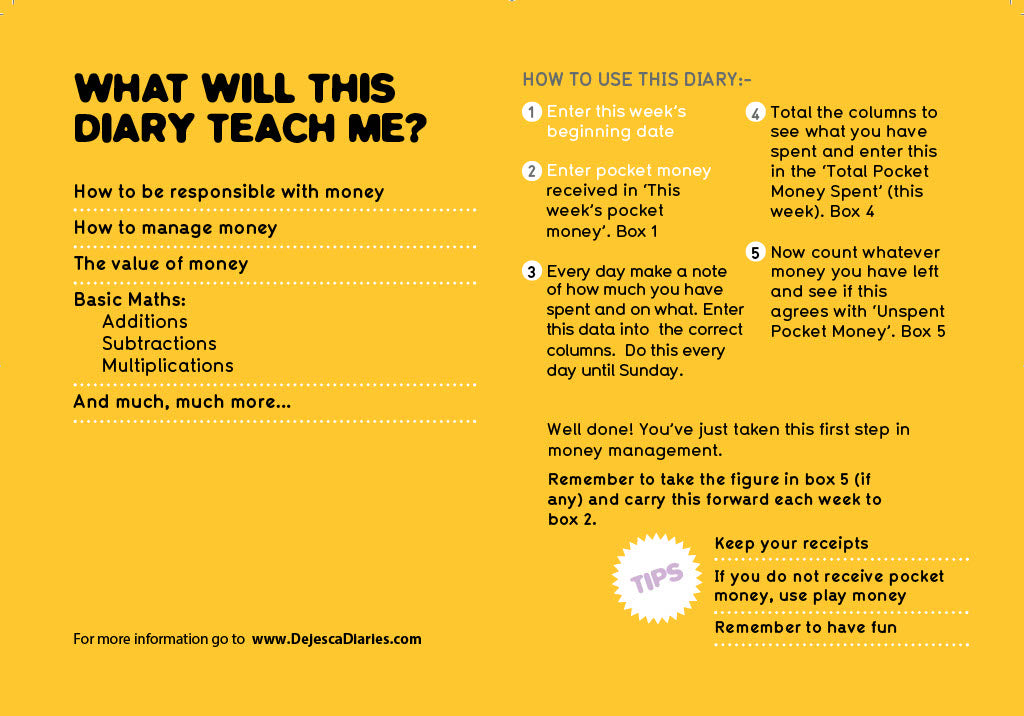

How to use....

Frequently asked questions?

-

Can my child do this without my help (adult supervision)?

No, as adult supervision is necessary. The diary was specifically designed needing parental interaction, and encourages bonding through the decision making process.

-

Do I need to know and understand finances in order to help my child?

No, prior knowledge of money management is not necessary as the diary uses a self guiding process. Your role as guardian is to listen and allow the child to navigate their decision making process.

-

I can not afford to give my child pocket money?

Actual cash is not needed as it's our modelling techniques and practical application that teaches the knowledge surrounding money. Play games like 'going shopping' with children using play money or imaginary money.

-

My child already uses a pocket money app, so why should I use a diary?

Whilst we appreciated the modern apps surrounding children and money management, we believe that a diary should be used before embarking on any app. Working with money even on a sensory level, brings a dimension that apps can not replicate, and this is crucial to a child's understanding. This diary builds the foundation and solidifies the understanding that money is a limited resource; linking this to good spending habits. The diary also promotes parental interaction and conversation and reduces screen time.

-

My child is older than 7, can they use the diary?

Absolutely. The management of money is a life long lesson with daily training. Scientific research has shown that self-regulation, problem solving, communication and self-esteem are formed in a child's early years that is why we recommend ages 4 to 7, but any age can use the diary as it teaches principles.

-

The tutorial shows GBP (£) symbol, can this diary be used in Europe and USA?

Some of the diaries sold in the UK have the £ symbol. Diaries sold in Europe & US are symbol free.

-

Do you have any more products?

We currently have three educational products in the pipeline which should be available to the market in October. Please subscribe to our mailing list and be the first to be notified.